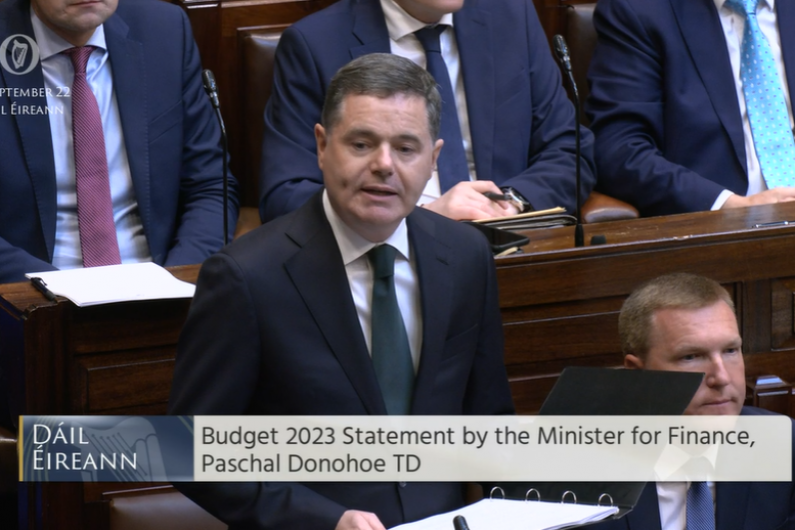

The biggest changes to income tax in more than a decade have been confirmed as part of Budget 2023. People won't start paying the higher rate of tax until they earn €40,000 meaning €800 a year back into the pockets of those earners.

Finance Minister Paschal Donohoe has also confirmed the creation of a Vacant Property Tax charged at three times the local property tax. In a blow to the hospitality sector the reduced 9 per cent VAT rate will be scrapped from February 2023.

While the Government has confirmed the carbon tax increases planned for next month will go ahead it will be offset by scrapping the National Oil Reserves Levy. The Finance Minister has also introduced a concrete blocks levy to pay for Mica redress at a rate of 10% on some concrete products from April 2023.

Meanwhile, a packet of 20 cigarettes will go up by 50 cent. The Minister says the public finances have recovered well since the Covid-19 lockdowns but remain vulnerable to other issues like the war in Ukraine and Brexit.

"This is why our public finances matter. They have recovered strongly from the effects of the pandemic and much of this recovery is due to the careful management of this Government," he added.

"We have undertaken appropriate responses to the unique challenges our country faced."